Adjusting to the New $750,000 Higher RAD Limit

While there was a collective sigh of relief when the Taskforce recommended increasing the threshold for higher RADs, residential aged care providers are at risk of complacency when resetting their accommodation pricing.

From 1 January 2025, the maximum Refundable Accommodation Deposit (RAD) that providers can charge without requiring IHACPA approval increased from $550,000 to $750,000 — a change intended to better reflect current accommodation costs. However, without a strategic review, providers may find their accommodation outcome falling short of a sustainable level in the medium term.

What We're Observing

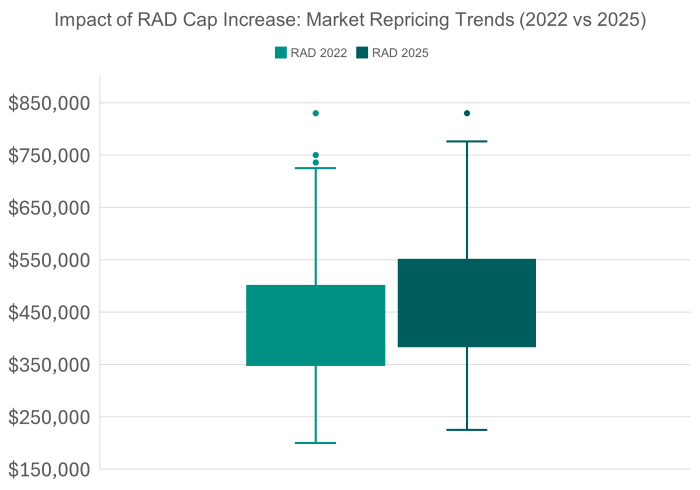

The chart below highlights how aged care providers in regional and outer regional NSW are adapting their RAD pricing strategies in response to the cap increase from $550,000 to $750,000. Our analysis shows that RAD prices are rising, and pricing strategies are becoming more diverse. While some providers have moved quickly to align with the new cap, most providers appear to be taking a more cautious approach, keeping rates at or below $550,000 to remain competitive.

We’re also seeing greater variability in pricing, particularly among providers positioning premium offerings at the higher end of the market. This suggests a broader market recalibration, where higher-end accommodations attract premium rates while affordable options remain available. As these shifts continue, we anticipate a growing role for DAPs and hybrid payment models, giving residents more flexibility in managing their accommodation costs.

Key Questions and Concerns

We highlight some key areas of concern for providers:

Will $750,000 become the new $550,000 default RAD barrier?

We’ve written how the $550,000 limit became an “artificial barrier” for many providers in setting accommodation prices – with providers choosing not to go through the higher RAD application process. This perhaps was due to administrative burden, lack of capacity and/or insufficient internal expertise.

While it’s tempting to set $750,000 as the new “standard”, accommodation prices must achieve three essential outcomes:

The recent inflation in the cost of building and the still pending review of the accommodation supplement mean that providing an appropriate return for providers to build and upgrade their facilities relies more on accommodation charges.

Simply increasing your RAD without referencing the return you need to generate sustainable returns from your accommodation will not address the losses that most providers currently derive from their accommodation services or allow you to undertake essential capital projects.

Will providers “set and forget” their RAD prices again?

We’ve seen this time and again - we are constantly confronted by providers who lack a process to regularly review and revise their prices. This means relative pricing is eroded over time. In the current climate, where house prices are skyrocketing, many providers are under-pricing their accommodation based on consumer affordability measures but haven’t reviewed them in light of the broader market.

Will IHACPA approve a Higher RAD?

With the RAD threshold now increased by 36%, it’s reasonable to assume that IHACPA might assume that most RAD prices should now fall below the new threshold. Such a situation would suggest that gaining approval for a RAD above this level could be more difficult than before the threshold was increased.

We are aware that some providers, including those offering Extra Service and Additional Services, are contemplating relying on higher RADs to replace this income. Setting aside that hospitality services cannot be considered when setting accommodation prices, convincing IHACPA that your proposed RAD represents value and is affordable to your residents is not straightforward when seeking to compensate for the loss of this revenue.

A recent submission we worked on involved multiple rounds of “Requests for Further Information” and took months to get across the line. Approval isn’t guaranteed and was only achieved in this instance because we had robust evidence-based arguments.

Can or should accommodation cross-subsidise hospitality services?

Many providers are in the habit of looking at the overall outcome of their operations. The government has set the care subsidy, so there is no capacity to use the margin on care to cross-subsidise accommodation and hospitality. This raises the question of whether you can rely on accommodation revenue, including the 2% RAD retention, to cross-subsidise hospitality services.

In our view, this is a high-risk strategy for the following reasons:

- Accommodation losses: Most providers are losing money on their accommodation, so accommodation charges must first be directed to generating a sustainable return from accommodation.

- Price differentiation: As the market settles, price differentiation for accommodation will be based on the unique features of the accommodation offered, and the price differentials will need to be appropriate to that difference. Any excess margin from accommodation will likely be eroded over time.

- Retention impact: It will take up to 3 years for the full impact of the 2% retention to be felt, and it only applies to the RAD you receive.

Do you understand the features and benefits of your accommodation?

We see a persistent tendency for providers to mirror local competitors’ accommodation prices rather than know and understand their accommodation's qualitative differentiating features and use them to demonstrate value at higher prices. This, in effect, forces potential residents to compare simply on price (RAD).

As the graph at the start illustrates, there is likely to be significant disruption in the market as providers adjust their prices towards the new $750,000 limit. Unless you understand and sell the benefits of your facility, you may not be able to achieve your new RAD pricing wherever you set it.

Key Recommendations

In light of the above, we recommend you focus on four key issues:

- Understand your value proposition: The median house price is simply the value of the house in the middle of a range of values; not everyone buys or owns a house with the median value. Similarly, not all residential aged care facilities have the same quality of built environment. When you can show the differentiating qualities of your facility and the benefits it gives to your residents, they can make a choice based on value rather than price. Achieving your target RAD/DAP, even if it's above your competitors, is possible with a sound pricing and selling methodology.

- Understand your local market: Pricing must reflect local affordability. The best proxy for this is the range of local house prices. Setting your RAD at the median almost invariably underprices your accommodation. We recommend setting prices between the 25th and 75th percentile of local house prices depending on the quality of your infrastructure.

- Avoid simple comparative pricing: This follows from the above. Setting rates based on competitors' prices is likely the least reliable way to put your accommodation price.

- Higher RAD applications: To maximise your potential to gain approval for higher RADs, expect to be more challenged by IHACPA and have strong evidence to address their key assessment criteria.

Implications and Opportunities

While the new higher RAD limit, the 2% retention, and the indexation of DAP offer significant opportunities for providers, unless providers focus on the accommodation pricing policy, there is a real risk that the future outcome will fall short of what is possible and desirable.

Our Accommodation Optimisation Services help you assess your current approach, identify opportunities for improvement, and ensure your pricing structure remains competitive and sustainable.

To find out how we can assist your organisation with accommodation outcome, contact George.

George Suharev

02 9068 0777

george.suharev@prideagedliving.com.au