Strategic Issues in Home Care Reform

Now that the dust has settled on the home care reform announcements, it is an opportune time to sit back and ask ourselves what strategic issues are contained therein.

Much of the recent conversation has been around individual elements of the reform, with concerns being raised about the level of the cap on Care Management fees, and increased complexity in the package. While these are legitimate concerns, our view at Pride Aged Living is that the package in its entirety is a viable program.

What you should look out for

Our concerns revolve around the reduction in choice and control that are inherent in the new structure, and the likely increased costs of the system as a whole, meaning both consumers and government will likely be worse off.

We’ve written about these issues in Australian Ageing Agenda's 'Unspent Funds' article and won’t go over them again here.

Complexity will be addressed in time through IT upgrades, staff training, and marketing collateral. Nothing in the package is particularly difficult to administer, just different to what it is now.

The cap on Care Management fees is also a non-issue from our perspective, given two important points to consider:

1. Cost Coverage

The StewartBrown benchmarking data indicates that almost all providers are spending between 9-10% of their revenue on Care Management and claiming 85% of the package value on delivering services.

This means that for every $100 of package value, they are currently spending $7.65-$8.50 on Care Management. The cap is set at $10, meaning that the amount is less generous, but will cover costs, and contain some Gross Margin.

2. Pricing Strategy

Talking about a single price point in isolation is not instructive. Most organisations don’t look at each individual price point and link it to a cost centre. They look at the pricing decision as a revenue mix decision and manage costs separately.

In essence, organisations have had two different pricing strategies they could pursue. Higher Fixed Care Management and Package Management costs, allowing for lower hourly rates, or the reverse. The decision was always about balancing marketing vs financial risk. Organisations currently charging Care Management at 10% and those charging at 20% are earning similar GMs and EBITDA margins.

Role of IHACPA

IHACPA’s price-setting work remains the single biggest risk to the viability of the sector. We do, however, have some faith in the price-setting process, both from the previous work they’ve done in the hospital sector, and the quality of the team they have on board. While we can expect some errors in the early stages, we expect these to be addressed more quickly than occurred with the NDIS.

So let’s assume we can manage these two issues, and that IHACPA completes their task competently. What then?

What remains the same?

Let’s first note that nothing in the reform program changes the business model much. We still need to hire and train staff, onboard clients, schedule services and handle the transactional load that supports this. We are still going to be investing in improved service models, some basic innovation, and consumer experience to the extent that we can gain a return on investment in a fixed-price environment.

What will change in 2025?

1. The service mix

New price signals are being sent, and consequently, we’ll see fewer clients choosing domestic services as part of their package, given that they will have to pay more. In many cases, they will purchase these from outside the package, given the cost advantage domestic cleaning services have over the two primary aged care awards.

2. The funding sources

The mix of funding from the Government will change, and we expect to see increasing levels of private funding entering the industry as well, expanding some marketing channels.

3. The administrative arrangements

There will be significantly different paperwork requirements, training requirements for office-based staff, collection requirements from clients, and so on.

4. Risk and finance

In the short term, there is some risk around price setting and ongoing margins.

None of these are particularly strategic issues though, and don’t affect the basic business model, or the functions that need to be undertaken within our business operations.

What was important before the announcement remains important after.

Our Framework

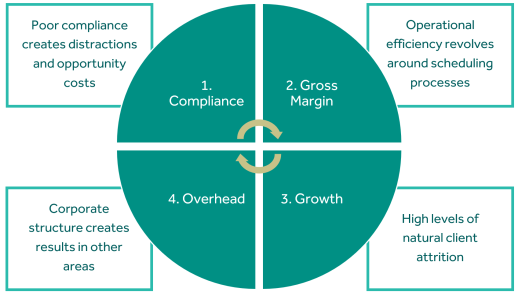

The framework that we use at Pride Aged Living when assessing our client’s performance won’t change. This framework is as follows:

Our experience with clients is that while most are focused on the first step in this process, and are dedicating adequate resources to their compliance programs, most are underperforming on the second.

This is a significant challenge for many organisations moving into a change environment.

Will there be margin contraction?

Our concerns around margin contraction are only at a moderate level in the short term, and at a lower level in the longer term. The key issue to note at a macro funding level is that while the average organisation is producing EBITDA margin at between 3-4%, the top quartile are averaging around 15%. With the average organisation only earning 3-4%, it is impossible to cut the total funding amount too far too fast without creating significant financial stress across the industry, and these signals should make their way to IHACPA quickly.

The difference between the margins earned by the average organisation, and the top quartile is merely process management. It is, therefore, entirely within the control of every organisation to almost completely eliminate this key risk in the transition.

Need a business performance review?

At Pride Aged Living, we have helped many organisations design road-maps that will take them into the top quartile, and are yet to find any organisation with any unique circumstances that aren’t able to achieve this and more.

So when considering operating in the new environment, focus on what you always have. Good strategy, good compliance and good process. If you get those things right, you’ll perform well throughout 2025 and beyond.

To find out how we can assist your organisation with home care, contact Jason.

Jason Howie

02 9068 0777

jason.howie@prideagedliving.com.au