Taskforce recommendations - our game plan to win in home care

We welcome the recommendations of the Aged Care Taskforce and believe they support the trend towards more choice for consumers and improved sustainability for providers.

Having spent most of my career as a CEO of a home care organisation, I thought I’d share what I would do in light of the Taskforce recommendations if I were still running a home care business.

Understanding the economic model

For me, the central question is what economic model do the recommendations support?

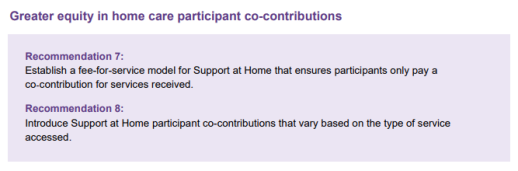

Caption: Department of Health and Aged Care - Final report of the Aged Care Taskforce, 12 March 2024

Taskforce recommendations 7 and 8 continue the journey from ‘Fixed Prices’ to ‘Reasonable Prices’ and now to a co-contribution system that contains price signals. This is in sync with the residential care model and is consistent with the one aged care system.

The Government contribution will effectively provide a safety net of care related services, with consumers paying increasing contributions for services beyond this. This is very much like additional services in residential care. At Pride Aged Living, we do a lot of work in this space, and I can see how it can translate to the home care setting.

From a provider perspective, the co-contribution model is a mechanism for increased consumer choice in the services they buy. It allows us to shift from spending the Government subsidy to designing a package of services that consumers want, and then working out how this is funded.

Another positive of this model is that if government funding levels fail to keep pace with cost increases, the consumer has the option to increase their contribution to maintain services.

Because the Taskforce recommendations are high-level rather than policy, questions remain about how the co-contribution system will work and whether any price points will be market-based.

Key considerations for providers

With this overview, I would ask my leadership team to talk to me about the following issues:

-

What scale of operations will be best suited to any of the likely policies that address the key recommendations?

To my mind, scale will be important, so I’d be looking to my leadership team to show me a growth plan. This could be organic, acquisitive or a combination of both. -

Growth is costly, so I’d be seeking validated assurance that our profitability is above average and to gain an insight into the level of growth that it will support.

No point in letting ambition get mistaken for ability, as this only ends in disaster. -

Organic growth can be through more clients or higher revenue per client.

In my experience, higher revenue per client is often ignored, yet there is strong evidence that it's easier to sell more to an existing customer than to a new customer, particularly if the customer is a customer of another organisation.

As I see the Taskforce recommendations supporting additional services, I’d ask my marketing department what we are doing to understand what services clients would buy and how we can earn a margin on this. This particularly applies to outsourced services. I see an increasing level of concierge services, where we connect our clients to service providers and earn a margin.

Top priorities

While there are other issues to consider, these are my top three priorities, and I would summarise them as:

- Understand your strategy - maybe you read our recent piece on the three types of strategy - Passenger, Dreamer and Driver - I’m firmly in the Driver camp.

- Focus on making your business processes efficient (pricing, promotion and production) - this will maximise gross margin and optimise your overhead structure.

- Execute your growth model—when you know where you want to go and you have the fuel to get there, it's time to venture into organic or acquisitive growth.

If you would like an outside perspective on your strategy and business model, give me a call, no obligation. I love hearing about how providers are looking to exploit opportunities.

To find out how we can assist your organisation with home care, contact Jason.

Jason Howie

02 9068 0777

jason.howie@prideagedliving.com.au