Understanding the Complexity of home care profitability

In August, we published the results of our analysis of the Aged Care Financial Performance Survey (ACFPS) and the Quarterly Financial Snapshot of the Aged Care Sector (QFS) on Residential Care, which highlighted some significant performance drivers and dismissed the myth that care funding is determinative of financial performance. In this insight, we consider the performance drivers of home care providers.

The reality

While these averages look respectable, the figures mask a number of issues that are important from a sustainability perspective. The QFS indicates that 21.6% of providers are unprofitable. The average profitability (7.2%) means that half the industry is forgoing significant profit due to poor management of their basic business processes.

To put this in perspective, we recently worked with a large not-for-profit organisation, and the gap between their actual performance and that of the average first quartile was a staggering $10 million annually.

There are many “rules of thumb” on what percentage of profit/surplus is required for viability and sustainability. Experience tells us that if an organisation:

- is achieving less than 5% surplus to sales, it is likely to be unsustainable and non-viable.

- has a margin between 5% and 10%, organisations are viable in the short term but often lack sufficient surpluses to reinvest in growth and innovation.

- has a margin exceeding 10%, there is sufficient excess surplus to invest in growth, innovation and development.

With the home care reform program well underway, and the likely outcome being a move towards commoditising service delivery, we predict most organisations will experience shrinking margins. Those organisations in the bottom half of the dataset are likely to see most of their margin evaporate. Those making losses will go further into deficit. This is consistent with our observations on viability.

If you want to be successful, you should imitate the successful players. With this in mind, we analysed the key factors of participants in the ACFPS to understand the interactions that high performers get right so that our readers can improve their operating performance and sustainability.

Every governing body should be continually testing the executive team as to whether they have the right business model and whether this business model is delivering a sustainable result. For providers who offer both home care and residential services, we often see limited understanding of the key drivers within the home care business. Often, this lack of focus is because critical residential care problems are consuming the board’s time. Given the gap between the top and average performance of home care providers for many multi-disciplinary businesses, improving home care results truly is low hanging fruit to boost overall organisational performance!

The drivers of financial outcome in home care

As with most endeavours, there is a small set of critical success factors that top-quartile performers focus on.

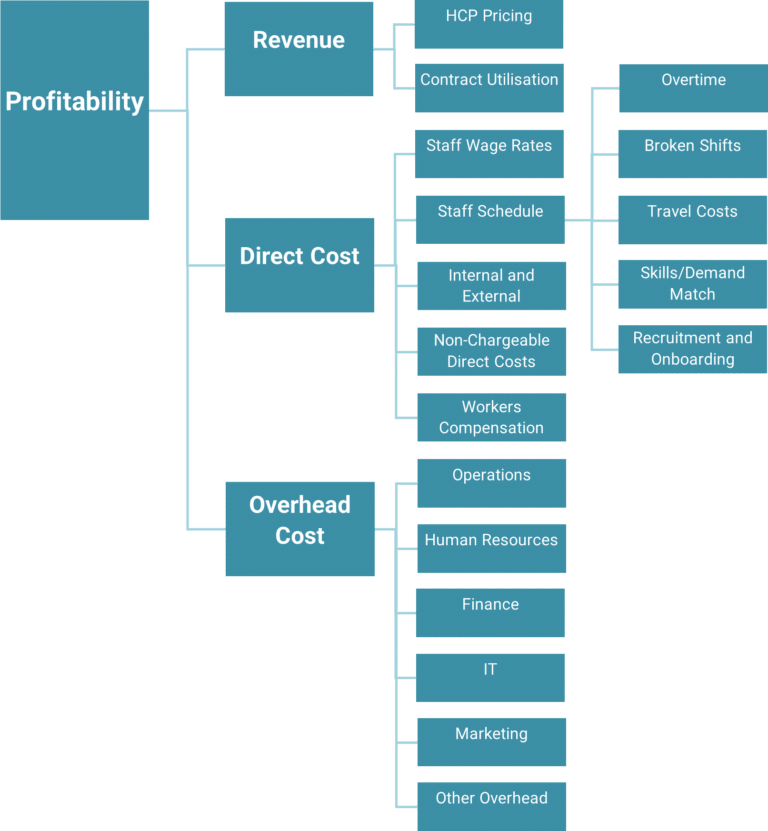

The following chart shows the areas that contribute to overall profitability. From this, we distilled four significant areas that, when given appropriate focus, can make the difference between being average and a star performer.

The four key drivers are:

- A strong compliance system and culture

Compliance problems become a major distraction for organisations when trying to manage performance into the future, not to mention the human cost and risk that can be created by underperformance in this area. - A robust sales and marketing function

According to the ACFPS, the average organisation loses around 30% of their clients each year to death, residential care and competitors. These need to be replaced and onboarded if the organisation is not to suffer a reduction in revenue. Organisations need to have a good handle on their marketing channels and a good business system for identifying potential clients and onboarding them. - Sound scheduling engine

The scheduling process in home care organisations is central to their financial results. Gross margins for home care packages sit around 45% in the top quartile, indicating that the scheduling team controls at least 55% of an organisation’s recurrent revenue. In spite of this, schedulers are comparatively low paid employees who create the operating result on a minute-by-minute basis. These staff are under constant pressure from clients and staff and tend not to be well supported by leadership, business intelligence or policy and process. - Efficient business processes to manage overheads

As most other functions across the organisation support the scheduling department, a best practice scheduling model tends to lower other costs through reduction of rework, automation of the process and efficient problem solving.

What the ACFPS and QFS tell us

Having a sustainable home care service is far more about how the team within your organisation performs than it is about the level of subsidy you receive. Let’s look at the evidence that we found to support this view.

Table 1 shows the difference in revenue per client per day (pcpd).

| Average Top Quartile | Average Top 50% | Average All Organisations | |

|---|---|---|---|

| Revenue (pcpd) | $69.79 | $67.53 | $68.84 |

| Percentage of Top Quartile | 97% | 99% |

The All-Organisations group has a higher level of revenue per client per day (pcpd) than the average of the top 50% despite having lower profitability and only $0.95 less than the top quartile providers. Clearly, gross margin is not driven by the revenue being generated on a per client basis.

Table 2 shows the difference in package utilisation among the groups.

| Average Top Quartile | Average Top 50% | Average All Organisations | |

|---|---|---|---|

| Package Utilisation | 85.4% | 85.3% | 84.9% |

Contract utilisation percentages are remarkably similar across all groups.

Given the diversity in gross margin and the consistency of package utilisation and revenue per client per day, the driver in the difference in performance is found in the organisation’s structure.

Table 3 summarises the difference in the key cost areas across the three benchmarked groups.

| Average Top Quartile | Average Top 50% | Average All Organisations | |

|---|---|---|---|

| Gross Margin | 44.9% | 43.6% | 41.4% |

| Care Management | 9.0% | 9.4% | 10.4% |

| Overhead | 20.7% | 22.1% | 25.3% |

| Operating Margin | 14.6% | 11.4% | 4.9% |

| Difference from Top Quartile | 0% | 3.2% | 9.7% |

The difference in financial outcome relates to:

- Scheduling (gross margin) 3.5%,

- Care Management 1.4% and

- Overhead 4.6%.

While the headline data points to a significant difference in overhead, most of the difference is explained by the difference in internal corporate recharges (11.4% for the all-organisation group compared to 7.7% for the top quartile group).

The difference between the average organisation in the top quartile and the top 50% group indicates a significant and rapid decline in gross margin for all but the top quartile and, to a lesser extent, a rapid decline in efficiency in care management activities.

Consider what your organisation could do with an additional $1 million! Would you invest in more training, IT systems, culture programs, or funds to subsidise charitable pursuits?

Operating margin and scheduling

Given this, we’ve decided to focus on initiatives that can improve operating margin in this Insight, as this has multiple benefits:

- Good scheduling equates to reliable services for clients

- Increased certainty for staff and

- Enhanced quality of life for clients

Achieving the benefits is about business processes and it starts with scheduling!

Unlike the complex issues facing the residential sector, which involve significant capital costs and large projects, home care’s problems are comparatively simple to fix.

In our experience, large numbers of organisations are underinvesting in their scheduling departments. This includes leadership, training, culture, and technology. The consequence of failing to invest in these areas may save a few dollars inside the office, but it costs many multiples of this saving in reduced gross margin.

Poor business processes in scheduling lead to blowouts in travel costs, excessive external purchasing, broken shift allowances, overtime, excess staff and client turnover, scheduling services with over-qualified staff, and excessive phone traffic from staff and clients. It also creates significant rework for Care Managers resolving issues with dissatisfied clients, including errors in statements, over-runs on budgets and inconsistent service delivery. Poor scheduling process leads to increased resources needed in care management.

Addressing poor scheduling will give providers a free kick in bringing down care management costs.

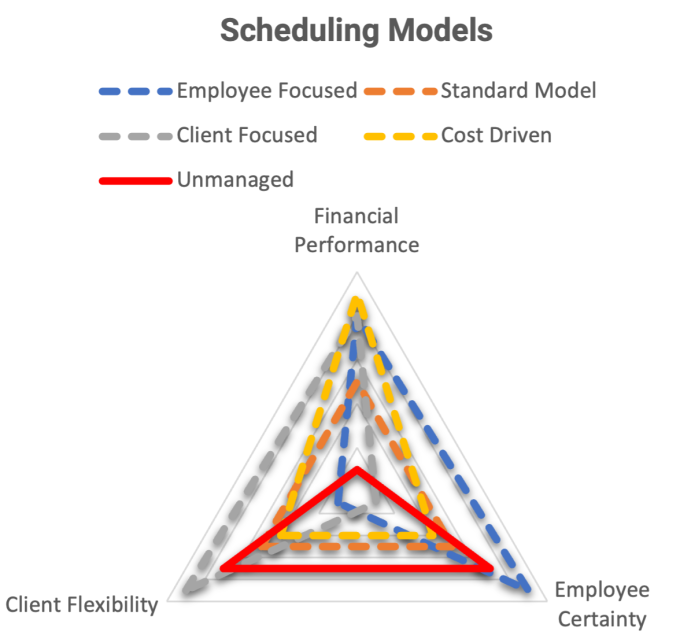

Scheduling in home care is a complex process. It is one of the reasons that home care should not be seen as a labour hire proposition. The chart above shows the three competing objectives of:

- The client’s desire for flexibility

- The employee’s desire for certainty

- The board’s desire for good financial performance

The nature of these competing demands is that they are in conflict with each other. In our experience, successful providers acknowledge that they can only outperform in two of the three domains.

In our experience, underperforming providers either explicitly or implicitly attempt to balance outcomes for staff and employees without adequate support to safeguard financial outcomes. This approach results in substandard financial performance.

Once you understand these competing forces, it’s easy to see how when organisations underinvest in scheduling departments, schedulers naturally attempt to please the two key stakeholders they are in contact with on a day-to-day basis – clients and care workers. So, it should be no surprise that a lack of structure to manage this inherent conflict is the root cause of poor financial performance for the organisation.

To make the situation worse, of course, the poor process control means that even for the resources being expended on satisfying these two stakeholder groups, the experience of these groups is still likely to be worse than it should be.

Whilst not a magic bullet, a sound scheduling engine gives home care providers the tools they need to make explicit decisions on where to set the balance between the client’s desire for flexibility, the employee’s desire for certainty and the organisation’s need for sustainable financial performance.

But the reform program is still unknown

Yes, it is. However, having led a significant organisation for more than 20 years in an industry that has been subject to ongoing reviews and change, I have yet to see a reform agenda that would cause investment in an efficient scheduling engine to be wasted.

Our advice is that organisations should take the opportunity to invest in their central business processes, increase their profitability, and set themselves up on solid foundations for the challenges and opportunities that will be created by the reform program.

A central component of success in the reformed home care sector will be an efficient system for matching clients and staff. Now is the time to act!

If you are struggling with any of the following:

- Understanding your scheduling systems

- Profitability

- Insourcing your outsourced services

- Demand forecasting and service delivery

Reach out to find out how we can help with your business model.

To find out how we can assist your organisation with home care, contact Jason.

Jason Howie

02 9068 0777

jason.howie@prideagedliving.com.au