You can't play catch up with RAD and DAP pricing

The Refundable Accommodation Deposit (RAD) and Daily Accommodation Payment (DAP) aren’t just mechanisms to recoup the cost of accommodation; they’re strategic financial levers that underpin your organisation’s sustainability and prosperity. Appropriately structured and promoted RAD and DAP fees have the potential to optimise capital and income, mitigate risk, and enhance market standing.

In this Insight, we explore the risks and lost opportunities when providers fail to update their RAD pricing, especially where their RAD is above the threshold of $550,000.

Many readers will not have had to worry about applying to the Independent Health and Aged Care Pricing Authority (IHACPA) for RADs above the approved limit ($550,000). Similarly, many people responsible for reapplying for approval have not done this before. If this is you, then the following might be helpful.

Getting a RAD approved – the rationale

If you want to charge a RAD above $550,000, you must get it approved by IHACPA. Relying on a single criterion, such as suburb or regional house prices, may not provide a strong enough argument for your higher RAD application to be approved.

When assessing and determining appropriate RAD pricing, IHACPA considers several factors including:

- Local and regional demographic data

- Affordability

- Competitor information

- The age and quality of the building and

- Amenities

Other factors may also contribute to your argument such as:

- The recent history and occupancy statistics

- Whether you have been discounting RADs - This may be viewed as an argument against approving an application and

- Whether your occupancy is high - High occupancy supports a view that your RAD is below market

Double dipping on additional services

We see many approved applications that include amenities or services such as Wi-Fi, TVs, phones, and bus trips. With providers' significant increase in the uptake of additional services (AS), we are seeing instances where these amenities are duplicated in the higher RAD application and the additional services package. IHACPA particularly looks for ‘double dipping’.

You should exclude any items specifically listed in the application for higher RADs from your AS package or vice versa. But be warned: If you exclude them from your AS, this may lead to a reduction in your AS package value. This can result in a need to lower your AS fee, negatively impacting revenue.

The CPI indexing challenge and opportunity

RADs help a provider’s balance sheet and provide capital for expansion, while DAPs help the profit and loss statement.

Once a resident is admitted, the RAD or DAP they pay is fixed for the duration of their stay – removing any opportunity to increase accommodation payment revenue. At a superficial level, you’d expect the accommodation price to go up by CPI. The regulations for higher RADs recognise this and allow providers to increase their RAD price on each anniversary date within the 4-year approval period, specified by IHACPA in the original approval letter. However, if you pass up the opportunity, you cannot catch up with the CPI increases in future years.

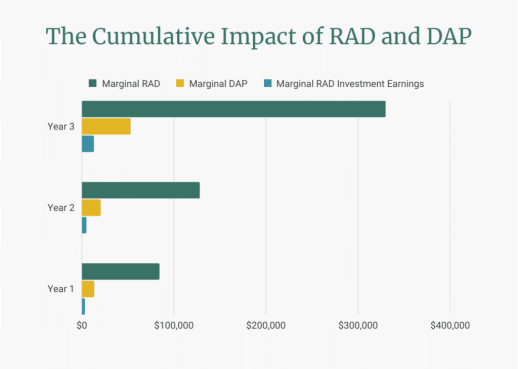

When making a profit is challenging, can you afford to let this amount of RAD, DAP and investment income be lost?

With no paperwork and no approval process required, it’s a no-brainer to simply diarise the anniversary date and apply the CPI to your RAD.

We found it surprising when working with providers to renew their higher RADs (they expire every 4 years), how often providers were not increasing their RADs by the annual indexation factor. IHACPA makes it simple with their indexation calculator.

We suspect the failure to increase RAD annually is related to:

- a lack of awareness of the opportunity,

- other pressures taking priority (for example, compliance issues),

- there is a sense you don’t think you can get a higher RAD, or

- staff turnover has impacted the ongoing management of RADs.

There is an important reason we recommend you take the indexation every year, and this relates to higher RAD expiry and approval. If you’ve regularly indexed your RAD and want to increase it further when you renew your pricing, the gap is less. This makes the approval process easier, as the increase you are asking for is coming from a higher base.

Higher RAD Approval Expiry

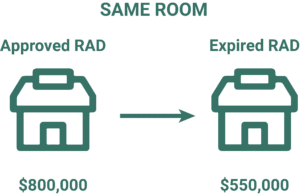

Many providers have not planned for their higher RAD approvals to expire and as a result, find themselves applying after the RAD approval has expired.

Often, this is because key personnel have left the business, and there is no system of tracking RAD expiry dates and delegating responsibility for the reapplication. If a higher RAD approval expires, the provider must drop their current RAD prices to the statutory maximum of $550,000. Clearly, this would have a negative impact on cash flow and profits.

If a provider is unaware of this, there is a significant risk they will be charging the higher RAD in contravention of the Fees and Payments Principles. Any overcharging must be promptly disclosed to the Aged Care Quality and Safety Commission.

This is not just a technical argument, as we have seen instances where Providers who have charged above the $550,000 amount where their approval has expired, have had to rectify the unapproved charging. This means refunding some of the RAD or DAP. In times of heightened criticism of the sector, this is a negative PR event every provider can do without.

Publishing Prices

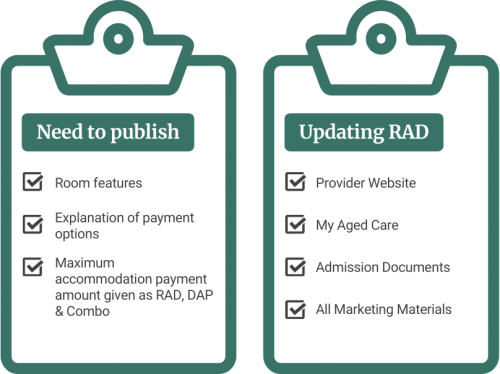

The Fees and Payments Principles set out your obligation to publicly disclose key information about room features, payment options, and the maximum accommodation payment amount.

As we’ve highlighted, there are three scenarios where a RAD price might be revised:

- Initial approval of a higher RAD

- Indexation

- Expiration of the RAD resulting in a decrease to $550,000

Does this make you feel overwhelmed?

As a provider, updating your RAD and applying for higher RAD approval is not a core skill. At Pride Aged Living, we submit many RAD applications and help clients access the CPI increase.

This means RAD applications are a core activity for us. We have a solid working relationship with IHACPA and we’re familiar with the issues they are concerned about. We know where to set the RAD and how to complete the application so that it goes through with the least amount of anxiety.

When you use Pride Aged Living, we help you set your RAD with confidence by:

- Reducing the administrative burden

- Navigating through the legal/procedural complexities

- Project managing, the process and your application process

To find out how we can assist your organisation with residential aged care, contact George.

George Suharev

02 9068 0777

george.suharev@prideagedliving.com.au