Our take on the Taskforce recommendations

We are concerned that the rush to analyse and digest the recommendations quickly has led to an overemphasis on the operational/ financial impact. By its nature, this is a short-term focus and brings with it the risk of waiting for Government to solve the problem rather than causing providers to focus on the strategic signals, both implicit and explicit in the recommendations.

While more money in the system means better short-term financial outcomes for providers, the long-term impact of this improved financial outcome on sustainability rests on the strength of the underlying strategy of each provider.

We have collated a list of ten strategic themes we consider significant. These are contained in the following table, together with our high-level view of the implications of these themes.

| Theme | Pride Living Observation |

|---|---|

| Co-contribution for “consumer costs” | Continued shift to consumer pays - the more they pay, the more interested they are in. Value and provider's financial sustainability is directly linked to how they set their consumer pricing. |

| Capacity to cover costs in residential care | No free market – Government will want their $ to be spent on consumers, not generating high profits for providers - the issue of care is politically sensitive. |

| Compound growth rate in home care demand to 2042 is forecast at 3.5% | While the relative balance between home care and residential care has shifted, both will see growth. |

| The aged care system will continue to evolve | This is not a permanent solution but one that works for now. |

| Quality requires a holistic approach | Quality of care is a contributor to quality of life, not an end in itself (refer 3 above) – consumer focus. |

| Investment of $37Bn needed for residential places | Residential care is not going away (code is Government can’t support a RAD system to deliver this capital) |

| A package of measures to improve accommodation funding | Watch this space – Government to be less involved. We expect to see viable models for Opco/Propco models similar to many areas in the economy. |

| The aged care system should support older people to live at home for as long as they wish and can do so safely. | Staying at home reduces the length of stay in a RACF. This creates virtual beds and is a partial solution to the future investment needed in the residential space. |

| Base accommodation around DAP, not RAD | Shifts the focus of accommodation to rent/yield from capital. This will pave the way for Opco/Propco solutions to capital needs. |

| Absolute and relatively more people getting home care | Increasing opportunity for episodic/short-term care (respite) offerings. |

If you subscribe to the view that business models follow from strategy, we suggest the appropriate response to the above Taskforce’s recommendations is:

- Assess the impact of the above themes within the recommendations on:

- your future in the sector - Stay, Grow or Go

- your strategic approach - Passenger, Dreamer or Driver

- If you decide to Stay or Grow, understand the implications of the recommendations on your business model.

With this context, we see five strategic questions that providers need to consider and form a view on:

- Choose to be a specialist or a generalist provider – What combination of residential care, home care or retirement living will your organisation focus on.

- Define your ideal customer profile and develop a market position (price, innovation, quality or reliability) and service offering that complements that profile (e.g. care needs, socioeconomic status, quality of life).

- Understand financial sustainability for your organisation – return on assets and operating performance required to be there in the long run.

- Articulate a compelling employee proposition – how will you win the hearts and minds of the people you need to deliver on your mission.

- Create clarity and focus – clearly articulate your focus initiatives and the areas you will not engage in.

Other Observations

We also consider the following tables and list of twelve non-strategic themes as helpful to providers considering how to respond to the Taskforce recommendations.

Department of Health and Aged Care - Final report of the Aged Care Taskforce, 12 March 2024

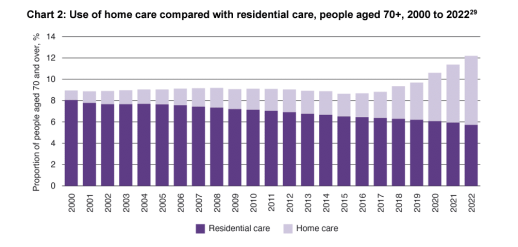

Chart 2 in the Taskforce report shows that the last 22 years have seen the percentage of service recipients increase from 9% to 12%. And a shift in the relative use of home care and residential care In 2020, circa 89% of recipients were in residential care. This percentage declined to just under 50% by 2022. If this service rebalance is complete, we can expect growth in both sectors going forward and the residential sector specifically.

Department of Health and Aged Care - Final report of the Aged Care Taskforce, 12 March 2024

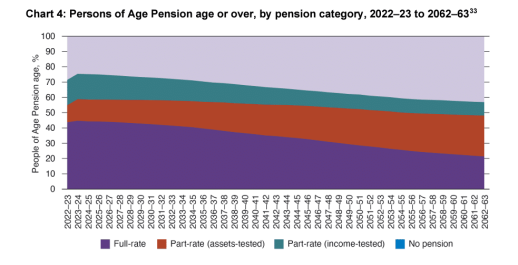

Chart 4 in the Taskforce report shows that the socio-economic mix of residents is forecast to continue to change – less supported residents and more self-funded residents, this is the impact of superannuation.

More of your future customers will have the capacity to and be compelled to pay more for your services.

| Theme | Pride Living Observation |

|---|---|

| Simpler, flexible and transparent | The consumer continues to be in the ascendency. Providers will need to be more commercial and consumer-responsive. Government will listen to consumers ahead of the industry. |

| Continued equity of access | Government to continue to provide/shift to a safety net funded position. |

| Clearly defined inclusion and exclusion principles in the service list | Government will pay for care and residents for non-care costs. |

| Recommendations are consensus - differences in opinion remain. Further thinking is needed by Government | It's highly unlikely that the recommendations will be accepted in full. Note no Government response to date. |

| Investment of $37Bn needed for residential places | Residential care is not going away (this is code for Government can’t support a RAD system to deliver the capital needed) |

| System-wide losses are driven by structural issues and rigid pricing structures | There will always be tension between politics, process and policy – optimise non-government revenue appropriate to your business model. |

| Income from superannuation should be drawn down in retirement to cover health, lifestyle, other living expenses and aged care costs. | Consumers need to be prepared to spend their children’s inheritance on aged care. |

| Aged care funding should support innovation | Tight finances drive innovation - limited future for those pursuing a Passenger or Dreamer strategy. |

| A package of measures to improve accommodation funding | Watch this space – Government to be less involved |

| An independent review in 2030 on the transition from RAD | That’s four elections away. Kick this one down the road, it’s politically and structurally difficult. |

| Review the accommodation supplement ... standard for the higher rate | Is this a shift to a required refurbishment investment similar to the retirement living sector to access the Higher accommodation supplement or a new higher supplement level for those who do another significant refurbishment? |

| Indexing DAPs | Depending on the length of stay, this may only have a marginal impact. However, it does support a rent model. |

To find out how we can assist your organisation with residential aged care, contact Bruce.

Bruce Bailey

02 9068 0777

bruce.bailey@prideagedliving.com.au